In early 2014, two congressmen from Louisiana, Bill Cassidy and Steve Scalise, asked FEMA to consider the width of drainage canals, water flow levels, drainage improvements, pumping stations and computer models when deciding the final flood insurance rate maps.

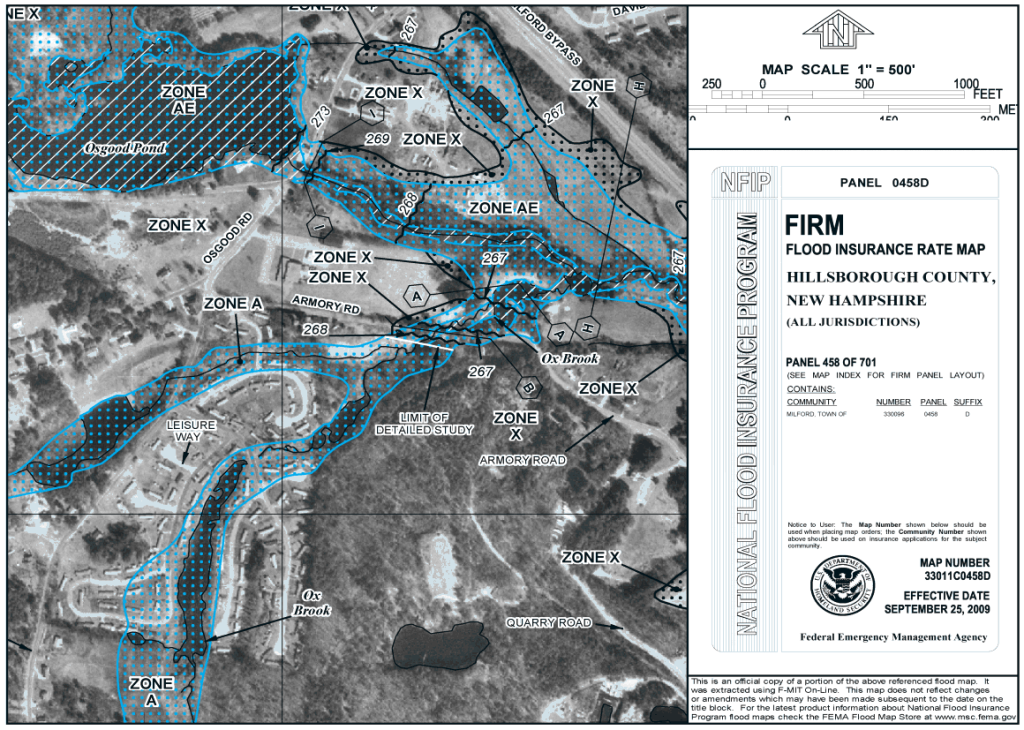

It is the most common map that FEMA produces, used by a variety of parties. The maps help community officials and local residents identify flood risks and are used for flood insurance, land use and development decisions. Flood Insurance Rate Map (FIRM) the official flood insurance map of a community on which the Federal Emergency Management Agency (FEMA) has indicated both the special flood hazard areas and the risk premium zones for the designated community. During that time period FEMA works with local communities to determine the final maps. Flood insurance rate maps identify flood hazard zones in Clark County, including the base flood area that has a 1 percent chance of being inundated in any year. High Hazard (Pink) High hazard flood zones have at least a 1 annual chance of flooding to the shown footprint and are commonly referred to as 100-year flood zones. Do you know your flood zone No matter where you live or work, some risk of. Legislation fully transferred the program to the. Search for a location: Select your current location. The new maps usually take around 18 months to go from a preliminary release to the final product. Property owners and communities can determine their current and future flood risk based on the preliminary Digital Flood Insurance Rate Maps (DFIRMs) As of September 7, 2021, DCED no longer houses or has responsibility for any aspect of the National Floodplain Insurance Program (NFIP).

#FLOOD INSURANCE RATE MAP UPDATE#

In 2004, FEMA began a project to update and digitize the flood plain maps at a yearly cost of $200 million. Please consult with your local, county, and/or community floodplain administrator for availability of official DFIRMs in your county. These FIRMs are used in identifying whether a land or building is in flood zone and, if so, which of the different flood zones are in effect. The user of this information should always consult official FEMA Flood Insurance Rate Maps (FIRMs) and certified elevation data if there is any doubt of a propertys flood risk.

#FLOOD INSURANCE RATE MAP SOFTWARE#

There are also some companies that sell software to locate land parcels or real estate on digitized FIRMs. FEMA sells the official FIRMs, called community kits, as well as an updating access service to the maps. These maps are called Flood Insurance Rate Maps (FIRMs) and help determine rates for flood insurance and are used by communities to manage flood risk by regulating. Some of the most well-known flood risk data sets are those produced by the Federal Emergency Management Agency (FEMA) and its partners. At that time a preliminary FIRM will be published, and available for public viewing and comment. There are several ways to map flood risk. Mail your questions to FEMA, 500 C Street SW, Washington D.C. Call the National Flood Insurance Program 1-88.

Go online Flood Smart and FEMA Mapping Tool. In the United States the FIRM for each town is occasionally updated. A PMR is a FEMA process that is used for large changes to the Flood Insurance Rate Map (FIRM) and are commonly used to incorporate MHFD Flood Hazard Area. Visit the Department of Planning office located at City Hall 810 Union Street, Suite 508 or use our online comparison mapping tool.

0 kommentar(er)

0 kommentar(er)